Challenges remain with high financing costs, limited inventory, and competition from other buyers, but most investors see better times ahead.

To download the full version of the Fall 2023 Investor Sentiment Survey, click here

SOUTH WINDSOR, CT – OCTOBER 2, 2023 – Real estate investors believe that market conditions have improved and will continue to get better in the coming months according to the Fall 2023 Investor Sentiment Survey from RCN Capital, conducted by market intelligence firm CJ Patrick Company. Almost three quarters of the investors surveyed (72%) said market conditions for investing were better or the same as a year ago, and 75% believed conditions would improve or remain stable over the next six months.

“Despite higher home prices, higher financing costs, and limited inventory, real estate investors continue to express optimism about market opportunities today and in the months ahead,” said RCN Capital CEO Jeffrey Tesch. “Investors continue to play an important role in the housing market – according to a recent report from CoreLogic, more than one in four home sales is to an investor, and we continue to see interest from both rental property buyers and fix-and-flip investors in our business.”

The Fall 2023 Investor Sentiment Survey is the second quarterly report from RCN Capital taking the pulse of real estate investors across the country, identifying market challenges and opportunities, and getting feedback on current trends and events.

Investor sentiment on the current state of the real estate market improved from the Spring 2023 Survey, with 49% saying conditions are better than they were a year ago compared to 30% in the spring. Views on the market six months from now also improved, with 44% believing conditions will improve, up from 30% in the prior survey. Despite the optimism, investors are moving forward prudently: only 22% plan to buy more properties than they did a year ago; 39% plan to buy the same number; and 39% plan to buy fewer.

“Interestingly, fix-and-flip investors seem much more optimistic about future opportunities – 50% of them believe that conditions will improve over the next six months compared to just 24% of rental property investors,” noted Rick Sharga, CJ Patrick Company CEO. “That may be an indication that flipping activity has bottomed out, but may also be a reflection of current challenges in the rental market, with rates continuing to decline even as more rental inventory comes online.”

Investors continued to see the impact of higher mortgage rates in their local markets. Over 30% have seen a decline in demand for owner-occupied homes; almost 21% have seen an increase in demand for rental properties; and 37% have noted both trends.

Recession Seems Likely, but Home Prices Expected to Rise

Despite being somewhat optimistic about the market environment going forward, over half of those surveyed (53%) believed that the US would enter a recession in 2023 or 2024. Only 18% said that the country would avoid a recession, while 29% were unsure. But even with a recession looming, investors overwhelmingly believe that home prices will continue to increase – almost 53% expect home prices to go up, 22% believe prices will remain about the same, and 24% believe they’ll decrease.

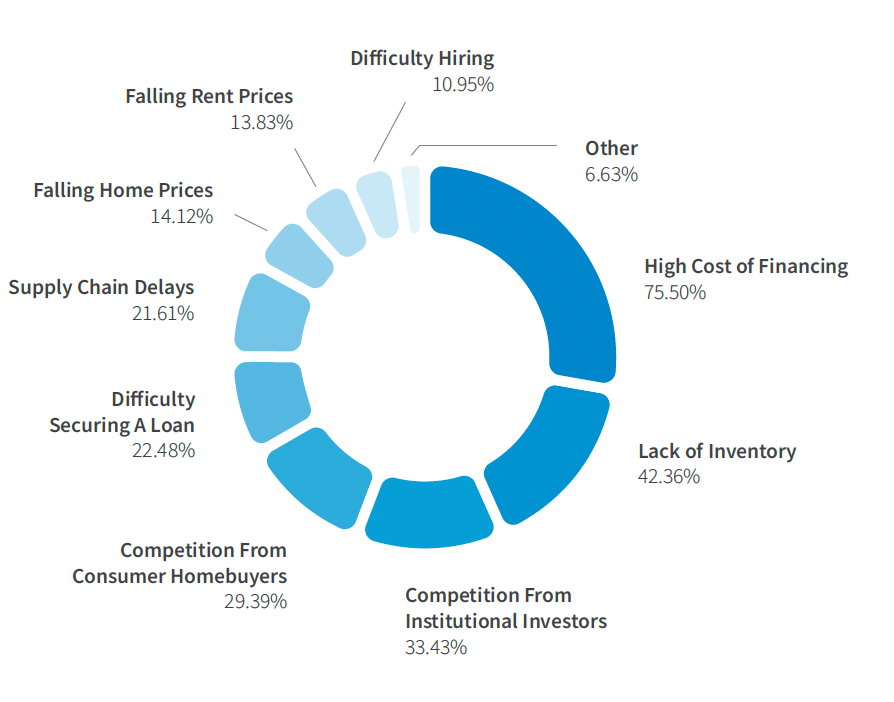

High Finance Costs, Limited Inventory, Competition Remain Main Challenges

Obstacles cited by investors in the fall survey mirrored those mentioned most often in the spring survey, and remain the main concerns by investors in the months ahead. The high cost of financing was the biggest issue among investors, being mentioned almost 76% of the time, while lack of inventory was mentioned over 42%. Competition from other buyers clearly remains an issue in today’s low inventory environment, with competition from institutional investors noted by 33% of the respondents and competition from consumer homebuyers by 29%. Other challenges mentioned frequently included difficulty in securing a loan (22%) and supply chain delays (22%).

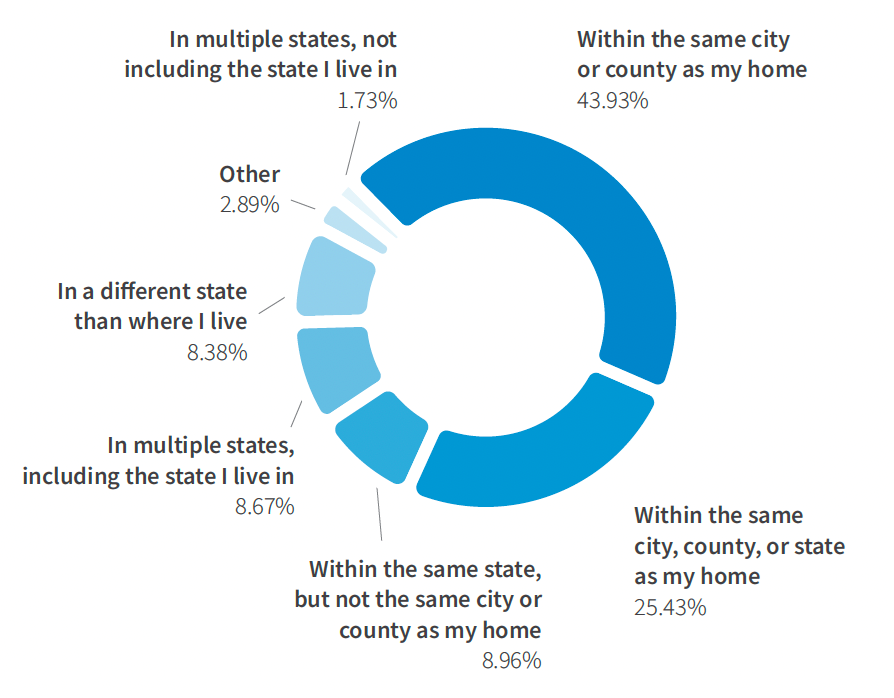

Most Investors Stay Close to Home

A new question added to the fall survey asked investors where they purchased their investment properties. Most focus close to home – 44% purchase within their hometown, and 79% within their home state. There were no significant differences in purchase distances between fix-and-flip and rental property investors.

To download the full version of the Fall 2023 Investor Sentiment Survey, click here or on the image below:

About RCN Capital

RCN Capital is a South Windsor, CT-based national, direct, private lender. Established in 2010, RCN provides commercial loans for the purchase or refinance of non-owner-occupied residential properties. The company specializes in new construction financing, short-term fix & flip and bridge financing, and long-term rental financing for real estate investors. For more information on RCN Capital and RCN’s loan programs, visit www.RCNCapital.com.

About CJ Patrick Company

Founded in 2019, CJ Patrick Company is a Market Intelligence and Business Advisory firm working with companies in the real estate and mortgage industries. Visit www.cjpatrick.com for more information.

Contact:

Erica LaCentra

RCN Capital

860.432.4782

elacentra@rcncapital.com

Rick Sharga

CJ Patrick Company

949-322-4583

rick@cjpatrick.com

.png?width=234&height=80&name=logo-white-1%20(2).png)